JMS YACHTING

Crew Relief Scheduling

Professional Guidance for Smooth Cross-Border Yacht Management

VAT & Customs Compliance Solutions for Yachts

VAT & Customs Compliance Yachts is an essential aspect of yacht ownership and management within the European Union and beyond. Understanding how VAT applies to yacht purchases, charters, and operations helps owners avoid unexpected costs, fines, or legal complications. Compliance involves proper registration, documentation, and awareness of destination-specific VAT rules. Expert guidance ensures that yacht operations remain efficient while meeting all regulatory requirements. With the right advisors, yacht owners can make strategic decisions regarding importation, leasing, and temporary admission. This compliance not only safeguards assets but also maximizes operational profitability for international sailing itineraries and charter activities worldwide.

Understanding VAT for Yachts

Navigating customs procedures is critical when it comes to VAT & Customs Compliance Yachts. Proper documentation of import and export declarations, proof of ownership, and vessel registration ensures smooth passage through international waters and ports. Customs authorities require clear, accurate records that validate the yacht’s origin, purpose, and consignment. Professional assistance plays a key role in reducing delays, ensuring adherence to tariff classifications, and addressing duty relief options available under specific jurisdictions. With well-organized customs strategies, yacht owners maintain seamless voyages and lawful status across borders. This also enhances operational reliability and ensures long-term compliance in global maritime operations.

Navigating Customs Procedures Efficiently

Effective VAT & Customs Compliance Yachts also involves proactive planning to optimize tax efficiency. By evaluating registration jurisdictions, ownership structures, and transaction timing, owners can significantly reduce their overall VAT liability. Skilled consultants develop compliant strategies for leasing arrangements, chartering models, and importation scenarios that meet both legal obligations and financial objectives. Optimization ensures smooth ongoing operations without disruption from unexpected fiscal adjustments. Furthermore, timely submissions and clear reporting maintain credibility with authorities. Yacht owners who prioritize VAT planning position themselves effectively for future growth, operational expansion, and sustainable chartering across prominent maritime regions worldwide while maintaining maximum fiscal prudence.

VAT Planning and Optimization

Accurate records form the foundation of VAT & Customs Compliance Yachts. Essential legal documents include certificates of registry, evidence of ownership, import declarations, and relevant tax rulings. Consistent updates in maritime regulations require ongoing awareness and regular checks to ensure compliance. Misinterpretation or missing documents can lead to costly delays or penalties. Professional services support yacht owners by maintaining standardized document control systems, scheduling renewals, and verifying adherence with the latest legal frameworks. This approach builds transparency and trust with regulatory authorities. A structured compliance system minimizes risks, protects financial interests, and helps ensure uninterrupted yacht operations across territories.

Documentation and Legal Requirements

Engaging experts in VAT & Customs Compliance Yachts provides continuous support throughout the ownership cycle. Advisors assist in reviewing charter operations, transits, and vessel usage to verify consistent legal conformity. They also communicate with tax authorities and handle documentation audits to ensure that all obligations are properly fulfilled. Expert consultants analyze regulatory changes that affect the global yachting industry, advising clients on necessary adjustments or exemptions. This ongoing partnership helps prevent non-compliance risks and supports optimized accounting practices. Professional guidance ensures confidence, efficiency, and stability for yacht owners navigating the complex world of taxation and customs compliance daily.

A FEW KIND WORDS

From our clients...

Captain, MY 45m Mangusta

You have done a fantastic job keeping track of all the receipts – I really appreciate how organized and accurate you’ve been! It’s been a pleasure working with you all, and I hope we’ll have the chance to collaborate again on a new project!

Chief Stewardess – MY 45m

Thank you so much for all your incredible help and patience – it’s been truly appreciated. I hope to be in touch again soon, wherever my next adventure at sea takes me. If not, thank you once more, Sophie. Stay safe and well.

Captain M/Y FEADSHIP

The financial management and reporting on our yacht has never been this accurate and on point as it is today with JMS Yachting.

Captain Jade 37m MY

I highly recommend Jansen Maritime Services to any yacht owner, captain, or industry professional looking for a management company that truly understands the intricacies of yachting. Their dedication, expertise, and seamless operations make yacht management stress-free, ensuring a world-class experience on the water.

Captain Alastair 55m MY

If you’re looking for a reliable, efficient, and highly professional yacht management company, look no further than JMS Yachting. I highly recommend them to any yacht owner who values exceptional service and a stress-free ownership experience!

Captain Marcus Boswell

I have worked extensively with Sam and JMS yachting over the past year, they have consistently presented excellent candidates for the positions that we have been looking to fill, who have been thoroughly vetted. They have been attentive to our requirements and assisted us in securing some excellent crew members, some at very short notice.

Captain Alex MY Khalilah

Our owner decided to change from private to commercial so we could charter Khalilah, we used JMS Yachting for the compliance management. The whole process ran smoothly, with JMS Yachting handling any issues with flag and class that arose, they also worked well in partnership with our charter brokers.

THE POWER BEHIND JMS YACHTING

Meet Your Worldwide Specialists

Effective global yacht management depends on being present and responsive in every time zone. Unlike many providers that rely on a single office with limited support desks, JMS Yachting operates from five fully resourced international locations. This ensures that Owners and Captains have access to comprehensive services, expertise, and decision-making power 24/7. By maintaining this global presence, JMS Yachting provides seamless continuity, offering the confidence that your yacht operations are supported by an experienced team wherever you sail.

Let us introduce you to the people behind your peace of mind – the specialists at JMS Yachting .

Franc Jansen

Founder, Managing Director

Languages: English and Dutch.

Certification: BSc (Maritime Sciences), MSc (Maintenance and Safety Management), CEng and MIMarEST.

With over four decades in the maritime industry, Franc’s career began in commercial shipping, working aboard cargo and cruise ships before transitioning into the yachting sector in 2005. As a qualified Navigational Officer, Marine Engineer, Technical Manager, and Class Surveyor, he brings a wealth of expertise to yacht management.

Recognised across the superyacht industry for his straightforward, client-focused approach, Franc was among the first to integrate commercial shipping discipline into yachting. His commitment to excellence and operational efficiency has set new standards in the field.

In 2015, he founded JMS, now one of the leading independent yacht management firms, with offices in Monaco, Palma de Mallorca, Fort Lauderdale, Dubai and the UK. JMS currently oversees the operational management of more than 50 yachts and has built a reputation for having one of the strongest technical teams in the industry, managing high-profile new builds and major conversion projects worldwide.

“The most technically qualified and experienced yacht operator I know!” Theo Hooning, SYBAss (Superyacht Builders’ Association)

In his free time, Franc enjoys engineering, speed and being on the open road. Building classic motorbikes is the gift that keeps on giving. He built a Café Racer from a 1981 Kawasaki and a Scrambler from a 1987 Moto Guzzi NX650. Living in the south of France, there is no shortage of mountain roads, coast roads and perfect weather to be out there all the time.

- Phone:+377 97 70 01 73

- Email:monaco@jmsyachting.com

Lucia Badano

Technical Director

Languages: Italian, English, German and Spanish.

Certification: Naval Architect with certification in ISM, ISPS, MLC.

Lucia brings a deep-rooted expertise in the yachting sector, having spent the majority of her career immersed in all facets of yacht classification, compliance, and technical oversight. With a distinguished background as a surveyor for leading flag states and classification societies, including RINA, Lloyd’s Register, the Cayman Islands Registry, and the Isle of Man, Lucia has handled virtually every technical and regulatory challenge the industry presents.

Her professional journey has taken her from plan approval and new construction supervision to inspections of existing vessels, covering the full lifecycle of yacht compliance and safety management. To broaden her maritime experience beyond yachts, Lucia also spent a year working as a superintendent for a bulker shipping company in Italy, adding commercial shipping insight to her already impressive portfolio.

Many of the world’s most iconic yachts carry her technical fingerprints. Lucia’s contributions have been integral to vessels such as MY Serene, SY Black Pearl, MY DAR, MY B, and numerous others, ensuring they meet the highest standards of construction and operation.

Lucia thrives on contrasts. Her passion for speed and power fuels her love for high-adrenaline pursuits, whether it is driving motorcycles, skiing downhill, or navigating winding mountain roads by car. Yet, she also cherishes moments of stillness and simplicity: spending quiet afternoons in her garden or sharing peaceful company with her cats.

- Phone:+377 97 70 01 73

- Email:spain@jmsyachting.com

Nabeel Hijris

Middle East Director

Languages: English and Arabic.

Certification: Master of Yachts 500 GT (Unlimited), Certified Marine Instructor.

Nabeel brings over 14 years of extensive experience in luxury yacht management, charter operations, and maritime leadership. With a distinguished career as a Fleet Captain and Yacht Captain, Nabeel has managed high-profile superyacht fleets and operations across the Middle East, Europe, and Asia.

His expertise spans the full spectrum of yacht operations, from implementing international safety and compliance standards to delivering elite charter experiences for VIP clientele, including celebrities and government officials. He has successfully supervised large scale refits and newbuilds, coordinated multinational crews of over 40 members, and overseen comprehensive fleet operations for vessels ranging up to 70 metres.

Fluent in English and Arabic, Nabeel combines technical precision with strong interpersonal and cross-cultural communication skills. As a Master of Yachts 500 GT (Unlimited) and a certified maritime instructor, he embodies JMS Yachting’s commitment to operational excellence and bespoke yacht management solutions tailored to Dubai’s growing yachting sector.

- Phone:+971 50 249 2667

- Email:dubai@jmsyachting.com

Nicholas Gray

President of JMS USA

Languages: English.

Certification: Master 3000 GT and Certified Diving Instructor.

Nick has over 18 years’ experience in yachting including 4 years ashore.

Born in Hamilton, New Zealand, Nick lived mostly in Tauranga, an amazing beach area. An incredibly active and passionate person who started sailing at 17 and completed all yacht courses to the Master 3000 GT. He is also a certified Diving Instructor.

Nick spent 1 year as a Deckhand and was then promoted to his first mates’ job on a 41 meter (135 feet) Lurssen, MY Blind Date and, thereafter, worked mostly on 50 meters (170 feet) up to 73 meters (240 feet) yachts.

Well-travelled, Nick has cruised the Mediterranean, Caribbean, Bahamas, East Coast US, South Pacific, Central and South America; and now lives in Fort Lauderdale, Florida.

During his spare time, Nick loves Rugby, spending time with his children and loves to BBQ.

- Phone:+1 954 533 5428

- Email:usa@jmsyachting.com

Rob Pijper

Operations Director

Languages: English and Dutch.

Certification: Surveyor, ISM, ISPS, MLC, and ISO certification.

Rob Pijper brings a formidable depth of technical, operational, and compliance expertise to his role as Operations Director, underpinned by a career spanning senior maritime leadership across classification, engineering, and vessel management. Holding a Chief Engineer Unlimited license, Rob has built a reputation for excellence in both commercial shipping and the yachting sectors.

He spent a significant portion of his career at Lloyd’s Register, where he held several high-level positions. Beginning as Senior Surveyor and Senior Auditor in the Port of Rotterdam, Rob went on to become Manager of the Marine Management Systems Office, overseeing ISM, ISPS, MLC, and ISO certifications, first in the Nordic Area, then expanding his oversight to the Western Area, and later all of Northern Europe. His leadership extended further as Operations Manager, responsible for field operations and plan approval across Western and Northern Europe, including key maritime nations such as Germany, the Netherlands, Scandinavia, Poland, the Baltics, Ukraine, Russia, and Belgium.

Following his tenure at Lloyd’s Register, Rob transitioned into yacht operations, taking on the role of Vessel Manager aboard the iconic converted tug/icebreaker MY Legend. In this multifaceted position, he was responsible for the vessel’s technical, operational, financial, commercial, and human resources management. His hands-on contributions have included the development of a comprehensive POLAR manual, the modernization of management systems, and oversight of major refits and warranty phases for several notable vessels—including MY Legend, the 90 metre (295 feet) Dar, the conversion of the 70 metre (230 feet) Project Master and the 74 metre (243 feet) MY Cocoa Bean among others.

Rob’s broad scope of experience, from compliance frameworks to vessel engineering and operations, makes him an indispensable figure in the JMS team, capable of navigating the most complex maritime challenges with technical rigour and strategic vision.

When he is not managing fleets or refining operational systems, Rob enjoys resetting his mind through maintenance work on old furniture and homes. Winter months find him skiing through scenic alpine terrain, while summer days are often spent sailing small open boats, reconnecting with the fundamentals of wind, water, and simplicity.

- Phone:+377 97 70 01 73

- Email:spain@jmsyachting.com

Sam Thompson

Group Commercial Director

Languages: English and French.

Certification: Cert RP and Master 3000 GT.

Sam began his yachting career back in 1994 working on an 80 metre (262 feet) yacht that led him on an epic adventure to Thailand. He hasn’t looked back since.

A qualified Master 3000 GT, he worked on six yachts including two new builds before moving on land to start a family and specialise in professional recruitment for the Oil & Gas industry and commercial shipping, working with industry leaders such as Technip, Subsea 7, BP Shipping and Bibby Ship Management.

A passionate sailor, Sam is a much liked industry professional whose known ability for getting things done is respected by Owners and Captains.

“Sam has been a massive help with finding new crew. Any crew he placed with us have been exactly what we were looking for, and are all still on board well over 12 months later.” Marc Van Loon 42 metres (138 feet), M/Y CLICIA

Outside of work, Sam enjoys cricket, watching and playing it. He notched up 220 runs ‘not out’ in a league game in the UK once. However since moving to the South of France, Sam has limited opportunity to play these days. Therefore, he has reverted to his second passion in life and bought a very old motor boat. He spent a large part of his adult life crewing yachts, passing on his enjoyment of the water to his kids and friends.

- Phone:+377 97 70 01 73

- Email:monaco@jmsyachting.com

Crew Relief Scheduling

See Some Of Our Clients’ Most FAQs

VAT & Customs Compliance Yachts refers to ensuring that yacht operations, purchases, and movements adhere to international tax and customs laws. Compliance ensures owners meet obligations under applicable jurisdictions while minimizing risks of fines, delays, or seizures from regulatory authorities abroad.

VAT compliance ensures that yacht transactions and movements remain legal under EU and international laws. Proper compliance avoids penalties, facilitates importation, and supports smooth charter operations. Additionally, it enhances financial efficiency by structuring transactions strategically under recognized tax frameworks for marine activities worldwide.

Customs procedures define how yachts enter or leave a country legally. They involve submitting accurate documentation, paying duties, and following temporary importation rules. Proper customs compliance under VAT & Customs Compliance Yachts ensures smooth navigation, avoids unnecessary fees, and validates ownership throughout international jurisdictions efficiently.

VAT registration might be required depending on the location, use, and ownership model of the yacht. Charter activities, importations, or commercial use typically mandate registration. Expert advisors in VAT & Customs Compliance Yachts ensure you follow correct procedures while optimizing registration based on jurisdiction laws and benefits.

Ignoring VAT & Customs Compliance Yachts can lead to substantial penalties, vessel impoundment, or restrictions on charter operations. Non-compliance may also harm reputation and cause delays in foreign ports. Ensuring appropriate compliance avoids these risks, protects investments, and maintains smooth operations across maritime borders globally always.

Yes, VAT recovery can be possible depending on ownership and usage type. Businesses or charters operating commercially may reclaim applicable VAT if the yacht qualifies under local or EU rules. Accurate records and compliance under VAT & Customs Compliance Yachts ensure successful recoveries and maintained legal standing.

Specialized tax and maritime consultants handle VAT & Customs Compliance Yachts effectively. They offer advisory on registration, document preparation, and procedural representation before regulatory bodies. Their expertise ensures that all statutory requirements are met, minimizing risks and optimizing fiscal advantages within international yachting operations continuously.

New To Yacht Ownership?

Your most common questions, answered clearly.

View some of our clients most FAQs.

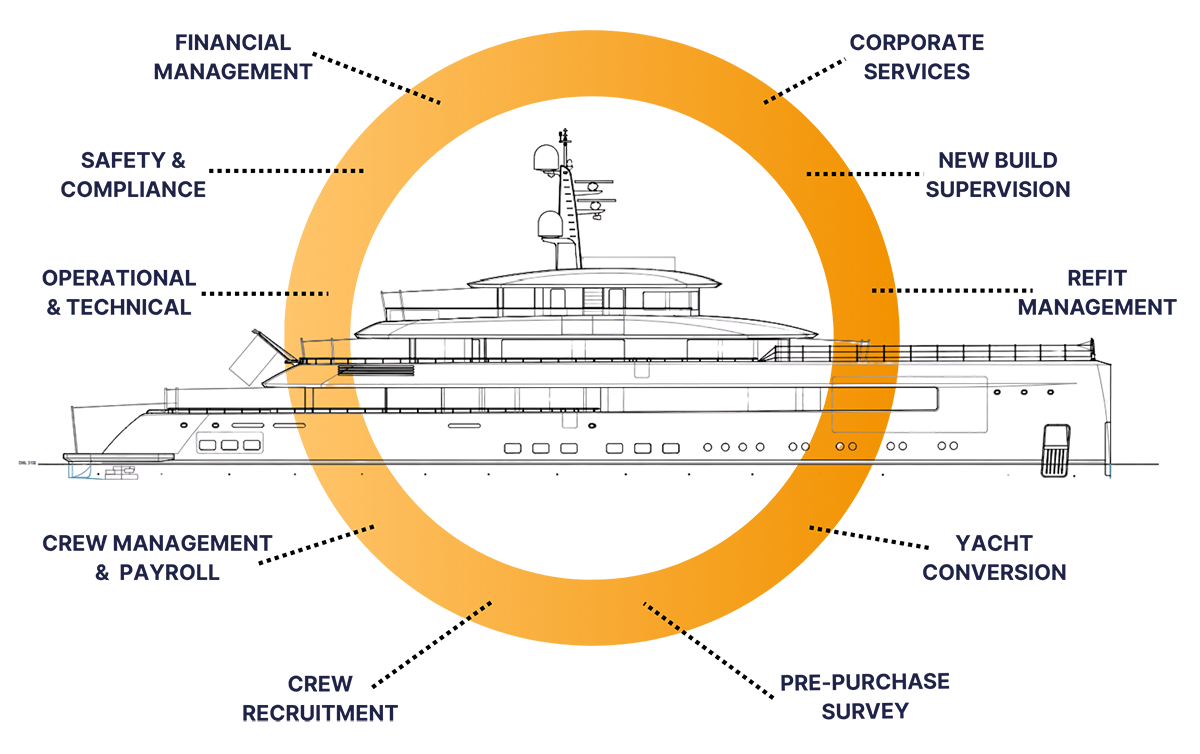

EXPLORE THE FULL RANGE OF JMS YACHTING SPECIALISED SERVICES

Over 200 Years’ Experience At Your Fingertips

Still Not Sure?

In life, you never know until you ask.

As Master Mariners, not sales people, we are here to guide you.